Ottawa Mortgage Blog

Your Trusted Ottawa Mortgage Experts

Sept 4th, 2024 - Bank of Canada delivers another rate cut

September 4, 2024 | Posted by: Jamie Small - Ottawa Mortgage Broker

The Bank of Canada delivered its third consecutive rate cut on September 4th, reducing the overnight rate by 0.25% to 4.25%. This significant decrease, totalling 0.75% since June, has lowered the bank prime rate from 6.70% to a more attractive 6.45%.

What does this mean for Borrowers?

Variable-rate mortgage holders will be happy to see another 0.25% drop in their interest rate. Your mortgage lender should be in touch to explain how the rate drop will impact your mortgage. Depending on the type of variable rate mortgage, the cut could either mean a reduction in your regular payment amount or a decrease in your remaining amortization. You should be receiving that communication shortly, if not already.Fixed rates have remained relatively unchanged since the rate cut last week. However, it's possible we could see some fixed rate drops in the coming days and weeks. Some experts believe that most future rate cuts from the BoC have already been priced into the bond market and, hence, into current fixed mortgage rates.

What's Next?

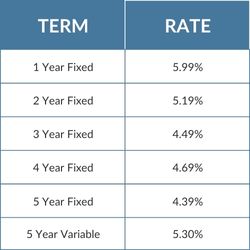

Economic indicators continue to show weakness in the economy, and inflation is clearly below the bank's target, paving the way for more rate cuts. Don't miss the next Bank of Canada rate meeting on October 23rd! In the meantime, here's a list of some of the best mortgage rates on the market today:

If you have questions about how today's announcement affects your mortgage, please don't hesitate to reach out.

For more information contact me, Jamie Small your Ottawa, Ontario Mortgage Broker today!